Small is Beautiful. Hands on Houses receives no government or large corporate grants. It happens because individual supporters and volunteers from around the world invest their time and money in making a difference.

To date, the project has provided more than 290 houses in rural village communities across five countries.

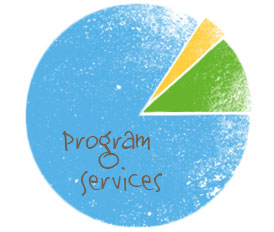

In 2020, the foundation used 82% of total expenses for program services, 8% for fundraising, and 10% for administration.

Hands on Houses is a project of The Equip Foundation, a 501(c)(3) nonprofit registered in the state of Hawaii having as its primary purpose “to act as an educational resource agency committed to bring leadership training in both developed and developing nations”.

You can download a copy of our original IRS determination letter (including name change registration) as well as the foundation's Articles of Incorporation below.

You may also verify our current tax status on the IRS website here, using our EIN at right.

The Equip Foundation is also registered for fundraising with the states of California and Washington.

The Foundation has accounts with Bank of Hawaii and Bank of America. Let us know if you need details.

Don Cook - Mission Director

The Equip Foundation 75-5660 Kopiko Street, C7-162 Kailua Kona HI 96740

Phone: +1 (808) 319-3317

Our federal Employer Identification Number (EIN) is: 99-0339365

You may request a copy of our recent 990 below - It can also be viewed online at guidestar.org (link below).

You can view our foundation's corporate and website policies at the bottom of this page.

The privacy of those who benefit from our work is important. So also is transparency in our work, and the ability to share with our supporters the stories of those we work for. In light of this, we work wherever possible to limit personal information (including geographical data such as GPS co-ordinates and images) that is available in the home country and/or immediate geographical surrounds of our beneficiaries. One of the ways we implement this policy is via geotargeting – for example most of the information on this site is not available to people browsing in India and surrounding countries.

Gift Acceptance Policy

The Equip Foundation

In addition to 4.17 of the Articles of Association, the Equip Foundation adopts the following policies for the acceptance of gifts.

Acceptance of any contribution, gift or grant is at the discretion of the Equip Foundation. The Equip Foundation will not accept any gift unless it can be used or expended consistently with the purpose and mission of the Equip Foundation.

The Equip Foundation will refrain from providing advice about the tax or other treatment of gifts and will encourage donors to seek guidance from their own professional advisors to assist them in the process of making their gift.

The Equip Foundation will accept donations of cash or publicly traded securities. Gifts of in-kind services will be accepted at the discretion of the Equip Foundation.

Certain other gifts, real property, personal property, in-kind gifts, non-liquid securities, and contributions whose sources are not transparent or whose use is restricted in some manner, must be reviewed prior to acceptance due to the special obligations raised or liabilities they may pose for the Equip Foundation.

The Equip Foundation will provide acknowledgments to donors meeting IRS substantiation requirements for property received by the foundation as a gift. However, except for gifts of cash and publicly traded securities, no value shall be ascribed to any receipt or other form of substantiation of a gift received by Equip Foundation.

The Equip Foundation will respect the intent of the donor relating to gifts for restricted purposes and those relating to the desire to remain anonymous. With respect to anonymous gifts, the Equip Foundation will restrict information about the donor to only those staff members with a need to know.

The Equip Foundation will not compensate, whether through commissions, finders’ fees, or other means, any third party for directing a gift or a donor to the Equip Foundation.

Version: 2 Approved by the Board on July 28, 2016.

Joint Ventures and Partnerships Policy

The Equip Foundation

In compliance with Internal Revenue Service guidelines for approval and management of any joint venture entered into by the Equip Foundation, the Board of Directors adopts the following guidelines.

Activities Subject to this Policy For the purposes of this policy, the term “Joint Venture” is defined as any arrangement, including contractual arrangements undertaken through a limited liability company, partnership, or other entity, though which the Equip Foundation and another entity jointly undertake any activity or business venture, or otherwise agree to joint ownership of any asset. A Joint Venture may include both taxable and tax-exempt activities.

Approval and Management of Joint Activities Before making any decision to participate in a Joint Venture, the Equip Foundation will ensure that the Joint Venture furthers The Equip Foundation’s exempt purposes and will negotiate at arm’s length contractual and other terms of participation that safeguard the Equip Foundation’s exemption from federal income tax. Such terms shall be in writing in the operating agreement of the Joint Venture and shall include the following minimum requirements:

Version: 2 Approved by the Board on July 28, 2016.

Conflict of Interest Policy

The Equip Foundation

The Equip Foundation’s conflict of interest policy is governed by Sec 4.18 of the existing Articles of Association as follows:

“This Corporation recognizes that transactions with interested Trustees, officers or agents are often highly beneficial to the Corporation given the understandable beneficence of the interested party toward the Corporation. However since such transactions always involve the potential, however slight, for private benefit, this Corporation has adopted the following policy for scrutiny for such transactions. No contract or other transaction between the Corporation and any of its Trustees, officers, employees or agents (hereafter “Interested persons”) or between any other entity of which such interested persons are Trustees or officers or in which such persons are financially interested, shall be either void or voidable because of such relationship or interest or because such interested persons are present at the meeting of the board of Trustees or a committee thereof which authorizes approves, or ratifies such contract or transaction or because his or their votes are counted for such purpose, if any of the following conditions are met:

(a) The fact of such relationship or interest is disclosed or known to the Board of Trustees or committee which authorizes, approves, or ratifies the contract or transaction by a vote or consent sufficient for the purpose without counting the votes or consents of such interested persons; or

(b) The contract or transaction is fair and reasonable to the Corporation.

Interested persons may be counted in determining the presence of a quorum at a meeting of the Board of Trustees or a committee thereof which authorizes, approves, or ratifies such contract or transaction.”

Version: 2 Approved by the Board on July 28, 2016.

Whistleblower Policy

The Equip Foundation

The Equip Foundation requires directors, officers and employees to observe high standards of business and personal ethics in the conduct of their duties and responsibilities. As employees and representatives of the The Equip Foundation, we must practice honesty and integrity in fulfilling our responsibilities and comply with all applicable laws and regulations.

Reporting Responsibility This Whistleblower Policy is intended to encourage and enable employees and others to raise serious concerns internally so that The Equip Foundation can address and correct inappropriate conduct and actions. It is the responsibility of all board members, officers, employees and volunteers to report concerns about violations of The Equip Foundation’s code of ethics or suspected violations of law or regulations that govern The Equip Foundation’s operations.

No Retaliation It is contrary to the values of The Equip Foundation for anyone to retaliate against any board member, officer, employee or volunteer who in good faith reports an ethics violation, or a suspected violation of law, such as a complaint of discrimination, or suspected fraud, or suspected violation of any regulation governing the operations of The Equip Foundation. An employee who retaliates against someone who has reported a violation in good faith is subject to discipline up to and including termination of employment.

Reporting Procedure The Equip Foundation has an open door policy and suggests that employees share their questions, concerns, suggestions or complaints with their supervisor. If you are not comfortable speaking with your supervisor or you are not satisfied with your supervisor’s response, you are encouraged to speak directly with the Board President. Supervisors and managers are required to report complaints or concerns about suspected ethical and legal violations in writing to the the Board President, who has the responsibility to investigate all reported complaints.

Accounting and Auditing Matters The Board President shall immediately notify the board of any concerns or complaint regarding corporate accounting practices, internal controls or auditing and work with the board until the matter is resolved.

Acting in Good Faith Anyone filing a written complaint concerning a violation or suspected violation must be acting in good faith and have reasonable grounds for believing the information disclosed indicates a violation. Any allegations that prove not to be substantiated and which prove to have been made maliciously or knowingly to be false will be viewed as a serious disciplinary offense.

Confidentiality Violations or suspected violations may be submitted on a confidential basis by the complainant. Reports of violations or suspected violations will be kept confidential to the extent possible, consistent with the need to conduct an adequate investigation.

Handling of Reported Violations The Board President will notify the person who submitted a complaint and acknowledge receipt of the reported violation or suspected violation. All reports will be promptly investigated and appropriate corrective action will be taken if warranted by the investigation.

Version: 2 Approved by the Board on July 28, 2016.

Document Retention Policy

The Equip Foundation

The Equip Foundation takes seriously its obligations to preserve information relating to litigation, audits, and investigations.

Electronic Document Storage The Equip Foundation does not retain any documents in paper form – all documents to be retained should be digitized and stored electronically, after which the paper originals are to be promptly destroyed.

Storage and Backup All electronic documents should be regularly backed up locally and remotely. If a user has sufficient reason to keep an e-mail message, the message should be saved as a PDF document and stored along with regular documents.

Schedule of Retention Documents should be retained in electronic format for the duration indicated in the table below. The information listed in the retention schedule below is intended as a guideline and may not contain all the records the Organization may be required to keep in the future. Questions regarding the retention of documents not listed in this chart should be directed to the President.

Corporate Records

Bylaws and Articles of Incorporation – Permanent

Corporate resolutions – Permanent

Board and committee meeting agendas and minutes – Permanent

Finance and Administration

Financial statements – 7 years

Auditor management letters – 7 years

Payroll records – 7 years

Check register and checks – 7 years

Bank deposits and statements – 7 years

Chart of accounts – 7 years

General ledgers and journals (includes bank reconciliations) – 7 years

Investment performance reports – 7 years

Contracts and agreements – 7 years after all obligations end

Correspondence — general – 3 years

Insurance Records

Policies — occurrence type – Permanent

Policies — claims-made type – Permanent

Accident reports – 7 years

Safety (OSHA) reports – 7 years

Claims (after settlement) – 7 years

Group disability records – 7 years after end of benefits

Real Estate

Deeds – Permanent

Leases (expired) – 7 years after all obligations end

Mortgages, security agreements – 7 years after all obligations end

Tax

IRS exemption determination and related correspondence – Permanent

IRS Form 990s – 7 years

Charitable Organizations Registration Statements – 7 years

Human Resources

Employee personnel files – Permanent

Retirement plan benefits (plan descriptions, plan documents) – Permanent

Employee handbooks – Permanent

Workers comp claims (after settlement) – 7 years

Employee orientation and training materials – 7 years after use ends

Employment applications – 3 years

IRS Form I-9 (store separate from personnel file) – Greater of 1 year after end of service, or three years

Withholding tax statements – 7 years

Timecards – 3 years

Technology

Software licenses and support agreements – 7 years after all obligations end

Document Destruction Beyond the retention time indicated above, documents should be securely destroyed. The President is responsible for the ongoing process of identifying records that have met the required retention period, and overseeing their destruction. Document destruction will be suspended immediately, upon any indication of an official investigation or when a lawsuit is filed or appears imminent. Destruction will be reinstated upon conclusion of the investigation.

From time to time, the President may issue a notice, known as a “legal hold,” suspending the destruction of records due to pending, threatened, or otherwise reasonably foreseeable litigation, audits, government investigations, or similar proceedings. No records specified in any legal hold may be destroyed, even if the scheduled destruction date has passed, until the legal hold is withdrawn in writing by the President.

Compliance. Failure on the part of employees to follow this policy can result in possible civil and criminal sanctions against the Organization and its employees and possible disciplinary action against responsible individuals. The President may periodically review these procedures with legal counsel or the organization’s certified public accountant to ensure that they are in compliance with new or revised regulations.

Version: 2 Approved by the Board on July 28, 2016.

Executive Compensation Policy

The Equip Foundation

The Executive Director is the principal representative of the Foundation, and the person responsible for the efficient operation of the Foundation. Therefore, it is the desire of the Foundation to provide a fair yet reasonable and not excessive compensation for the Executive Director (and any other highly compensated employees and consultants).

Determination Proces The annual process for determining compensation is as follows: The board of directors shall annually evaluate the Executive Director on his/her performance, and ask for his/her input on matters of performance and compensation. Board members may obtain information to make a recommendation for the compensation (salary and benefits) of the Executive Director (and other highly compensated employees or consultants) based on a review of comparability data. This data may include the following:

Documentation To approve the compensation for the Executive Director (and other highly compensated employees and consultants) the board must document how it reached its decisions, including the data on which it relied, in minutes of the meeting during which the compensation was approved.

Independence in Setting Compensation The Chair of the board of directors, who is a volunteer and not compensated by the Foundation, will operate independently without undue influence from the Executive Director.

Version: 2 Approved by the Board on July 28, 2016.